Hiring employees is an essential aspect of running any business, and it's a critical step that can be costly. As an employer in Australia, you need to be aware of the costs associated with hiring an employee, and how they can impact your business.

From wages and benefits to superannuation contributions, employers need to be aware of the overall cost when considering hiring new staff. Let’s discuss the different costs and main factors that should be considered when budgeting for a new hire in Australia.

Benefits of Hiring in Australia

Employing staff in Australia offers a range of significant benefits for businesses. One of the biggest benefits of hiring in Australia is being able to tap into a highly educated and diverse talent pool. 47% of the Australian workforce has achieved a tertiary qualification. Furthermore, Australia ranks 1st in the OECD for its capacity to attract and retain highly educated people.

With a booming economy and low unemployment rates, there is no shortage of talent in Australia to hire. Now, let's take a closer look at the costs involved in hiring an employee in Australia.

Required Costs of Hiring

Minimum Wage

In Australia, the Fair Work Commission sets the minimum wage and as of 2022, the national minimum wage is AUD21.38 per hour. The minimum wage may vary depending on the industry and the level of experience of the employee.

Penalty Rates & Overtime Pay

Penalty rates are higher pay rates that employers must pay employees for working particular hours or days, such as the weekends, public holidays, overtime, late night shifts or early morning shifts. Penalty rates depend on your industry and whether your shifts are designated.

.avif)

In terms of overtime, these rules apply:

From Monday to Saturday, employees are paid 150% of their hourly wage rate for the first two or three hours of overtime worked. After that, it is 200% of their hourly wage rate per overtime hour worked. On Sundays, overtime is paid at 200% of their hourly wage rate per overtime hour worked.

During a public holiday that falls on Monday to Friday, overtime is paid at 150% of the hourly wage rate for the first 7.6 hours and at 250% of the hourly wage rate thereafter. When a public holiday falls on a Saturday or Sunday, overtime is paid at 250% of the hourly wage rate.

Part-time employees working overtime will be paid their normal hourly rate within 38 hours. For any overtime worked more than 38 hours, the above-mentioned conditions will apply for overtime.

Superannuation

Superannuation (a.k.a super) is a compulsory contribution made by employers to their employees' retirement savings. As of 2022, the superannuation guarantee rate is 10.5%, and it's expected to increase to 12% by 2025. This means that if you hire an employee with a salary of $50,000 per year, you'll need to contribute $5,250 per year to their superannuation account.

For those on higher incomes, employers may also need to pay a superannuation surcharge, which is set at 15% of any amount over AUD250,000 per year. It’s important to note that these contributions are made in addition to the wages paid by the employer.

Superannuation contributions are an important part of hiring an employee in Australia and must be factored into any calculations related to salary packages and costs associated with hiring staff. Understanding your obligations here will help ensure compliance with government regulations and provide peace of mind for both employer and employee alike.

Payroll Tax

Payroll tax is a state-based tax that employers pay on their total wage bill. The tax rate varies between states, but as a general rule, you'll need to pay payroll tax if your total wages bill exceeds the state's tax-free threshold. For example, in New South Wales, the payroll tax rate is 5.45% when the tax-free threshold is AUD1.2 million per year, while in Victoria, the payroll tax is 4.85% when the tax-free threshold is AUD700,000 per year.

Employers are required to register with the relevant department and keep up to date with changes in rates and thresholds. Additionally, some states offer exemptions or concessions for certain categories of employees.

Workers' Compensation Insurance

Workers' compensation insurance is mandatory insurance that employers need to have to cover their employees in case of a work-related injury or illness. The cost of workers' compensation insurance varies depending on the industry and the size of your business.

Paid Vacation & Leave Loading

Most full-time employees receive 4 weeks of paid annual leave for each year of employment. Part-time workers also have the right to 4 weeks of annual leave, but their entitlement is calculated on a proportional basis.

Additionally, employees may qualify for an extra week of paid annual leave if they meet one or both of the following conditions: they often work shifts on Sundays and public holidays, or they are employed by a company that runs continuously, 24 hours a day and 7 days a week.

Typically, annual leave is remunerated at the regular hourly rate, although it may also include an additional payment known as annual leave loading, which usually amounts to 17.5% of ordinary pay. This loading is intended to cover any expenses an employee may incur while taking annual leave, and it is paid on top of their normal salary.

Sick Leave

Except for casual employees, all workers are eligible for paid sick and carer's leave under the National Employment Standards (NES). To receive compensation for these types of absences, employees may need to provide notice or supporting documentation, such as medical certificates. Paid sick and carer's leave is classified as a single entitlement and is often called personal/carer's leave. The annual allocation of leave is determined by an employee's regular hours of work, with full-time personnel being granted 10 days and part-time staff receiving a prorated amount, equivalent to 1/26 of their ordinary hours of work per year.

Parental Leave Pay (PLP)

In Australia, eligible employees who are the primary care givers of a newborn or newly adopted child can receive up to 18 weeks of Parental Leave Pay (PLP) from the Australian Government at the National Minimum Wage. This is in addition to paid parental leave that the employee may receive from their employer. The first 12 weeks of PLP is a set period that must be taken continuously within 12 months of the child's birth or adoption. The second period allows an employee to use up to 30 days of flexible PLP within 24 months of the birth or adoption. Flexible PLP can be taken in periods as negotiated by the employee and employer.

Often, the Australian Government makes PLP payments through the employer, who pays the employee. Employers can provide paid parental leave in enterprise or other registered agreements, employment contracts, and workplace policies too. The amount of leave and pay entitlements depends on the relevant agreement, contract, or policy. However, employer-funded paid parental leave doesn't affect an employee's eligibility for the Australian Government's PLP Scheme, and employees can receive both.

Employers that have employees receiving Australian Government-funded PLP are required to keep records of the amount of PLP funding received, the date each payment was made, and the gross amount of the payment, among other details. Additionally, employees receiving PLP must receive a pay slip for each payment that specifies the payments are PLP under the Australian Government PLP Scheme.

Recruitment, Training & Administrative Costs

Recruitment costs can include job advertising, recruitment agency fees, and other expenses associated with finding and hiring the right employees. These costs can vary greatly depending on the method you use to find your new employee, the industry, and the level of experience you require.

The average cost of recruiting a new employee in Australia is around AUD$23,000, according to the HR Industry Benchmark Survey in 2021. This includes training, which accounts for 1.5% of the AUD$23,000, as well as other costs such as equipment, onboarding, and induction processes.

It's essential to make sure that your new employee is adequately trained to perform their duties and responsibilities, and this may require some investment on your part. Training costs can be significant, especially if they require specialized skills or knowledge. Employers may choose to invest in developing their staff through workshops, seminars and conferences, as well as online learning resources or formal qualifications such as college diplomas or university degrees. Employers may also offer to cover co-working space memberships or other stipends.

Another thing to keep in mind is that it takes employers about 40 days on average to fill a vacant position. During this time, employers should consider the loss of productivity when the job is vacant – another cost the business must absorb.

Optional Costs of Hiring

Other Costs

Don't forget that there are also ongoing costs associated with employing someone, such as payroll processing fees, and other benefits that you may offer your employees, such as professional memberships, health or travel insurance or gym memberships.

On top of everything, employers should consider the costs of visa applications for international staff if they plan to hire non-Australians in Australia, such as fresh graduates or employees who are very specialized. The cost of a visa application varies depending on the type of position being filled, with skilled worker visas costing significantly more than holiday or student visas.

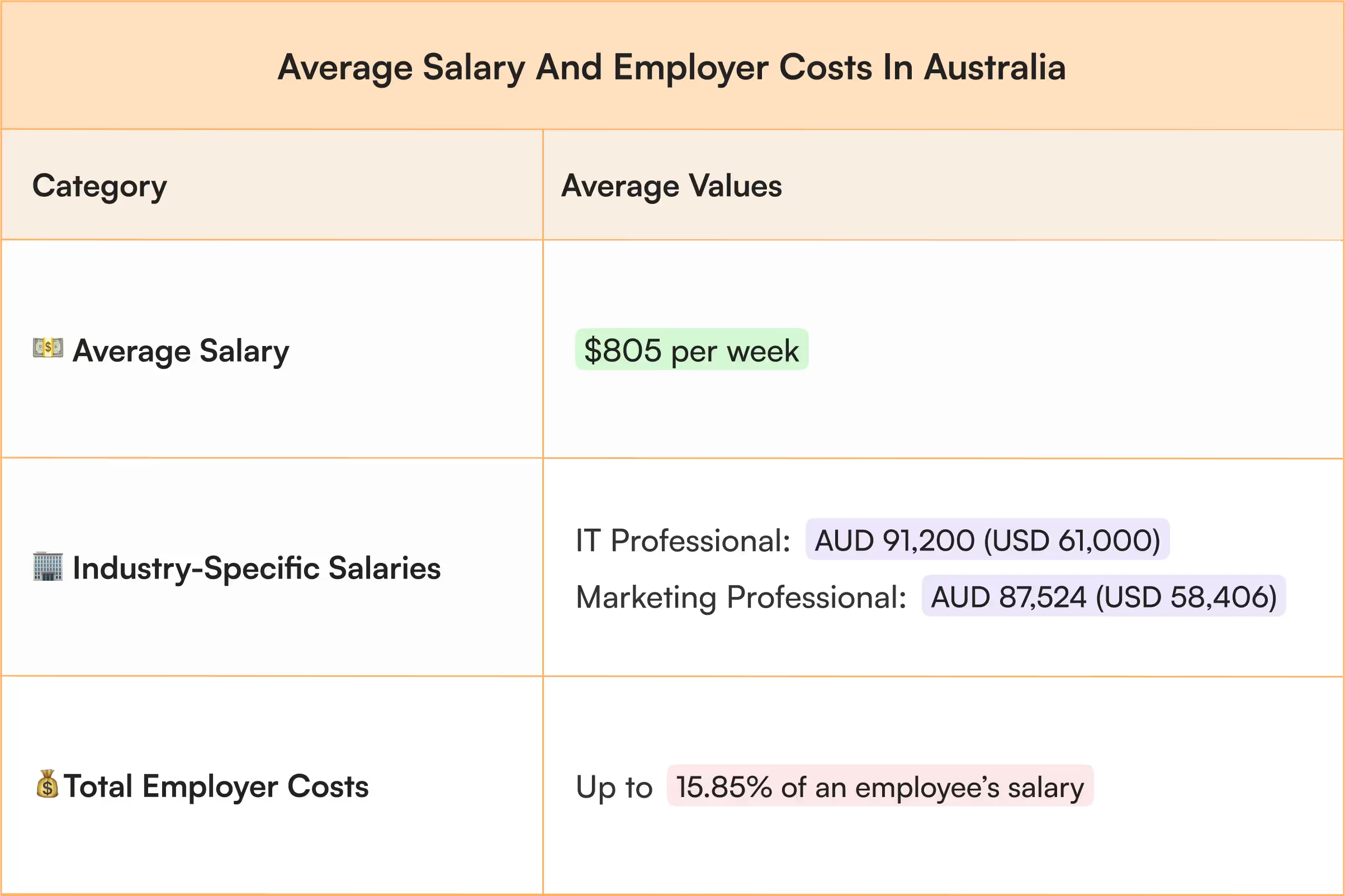

Average Salary & Employer Costs

As of 2023, the average Australian salary is $805 per week. This varies from industry to industry. For example, the average annual salary for an IT professional is AUD91,200 (USD61,000) while the average annual salary for a marketing professional is AUD 87,524 (USD 58,406).

Taking everything into account, from superannuation to healthcare, the average employer costs up to 15.85% of an employee’s salary.

Borderless Can Help You Cover The True Cost of Hiring in Australia

In conclusion, the average cost of hiring an employee in Australia involves a range of factors, from the minimum wage to recruitment and ongoing expenses. Once again, the average cost of simply hiring in Australia is approximately AUD$23,000, so it's essential to factor in these costs when making hiring decisions. Make sure that you can afford to employ and maintain a productive workforce. Unsure about the costs involved? An EOR like Borderless is here to help you hire the best in Australia.

Book a demo! Let’s work together.

Disclaimer: Borderless does not provide legal services or legal advice to anyone. This includes customers, contractors, employees, partners, and the general public. We are not lawyers or paralegals. Please read our full disclaimer here.